|

View web version | 01/27/2026 |

|

|

|

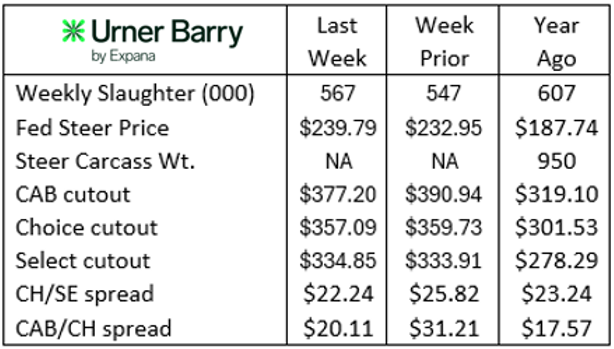

Federally inspected cattle harvest head counts have swung widely in the past three weeks, beginning with a 14,000 head decline two weeks ago as one fed cattle plant idled several days for scheduled upgrades. Last week’s recovery from the downturn pulled the week’s total 9,000 head larger than the six-week average.

Late last week, President Trump made statements about potential action to lower beef prices through purchases from Argentina. That brought an abrupt end to a precipitous nine-day run in which nearby Live Cattle contracts rose more than $13/cwt. without correction. Friday’s Feeder Cattle futures were limit-down and Live Cattle futures traded sharply lower as a result. |

|

|

Follow-up trade early this week showed resiliency in futures prices as the market has shrugged off the President’s comments, regaining much of the price slippage incurred on Friday. For instance, the April 2026 Live Cattle contract touched the high-water mark of $250/cwt. last Thursday before settling $7.28/cwt. lower by Friday’s close. By Tuesday morning, a $3.05/cwt. recovery pulled the April contract up to $246/cwt..

Cash fed cattle prices last week showed no resemblance to Friday’s futures setback with fed cattle averaging $239.79/cwt., a $6.84/cwt. increase on the prior week. Seasonal increases in wholesale cutout values are expected to continue at least through the end of October. This potential, along with strong packer demand to capture a large head count last week, has propped up prices for now. |

|

|

Heavy Lifting Ahead for Cutout Values |

|

The typical October beef market is marked by a strong swing in carcass cutout values as a lull in demand follows Labor Day, sending cutout values to a seasonal low beginning in October. The turnaround happens quickly, with cutout values in early October 2% below the year’s annual average. By month’s end, prices averaged 1% above the annual average in the last three years.

In order for this pattern to repeat in 2025, the Comprehensive cutout would need to gain $10/cwt. in the next 10 days. This would be a fairly large lift, but not out of the question. One factor we must bear in mind is that 2025 wholesale carcass prices have varied widely within a range of $87/cwt. This compares to a much tighter average trading range of just $25/cwt. in the prior three years. This year’s Comprehensive cutout values are averaging 16% higher than last year, therefore, a 3% shift means a larger dollar value move than last year.

The above information seems less closely tied to potential fed cattle prices this season since a significant disconnect exists between cutout values and fed cattle values. Packers have, after all, run deep in the red for many months this year. Narrower margin losses do, however, encourage larger harvest levels. |

|

|

A look at individual beef cuts and seasonal price trends for the fourth quarter reveals a few impactful cuts will shoulder the load toward higher prices. It’s evident that ribeyes and tenderloins come into focus for the holidays. Even so, the steep uptrend began in August for these items, leaving seemingly less upward lift available. Most would agree that despite current price levels, 20-30% higher than a year ago, new record-high prices are in the cards for early December.

Strip loins have continued to be sought after as the cheaper steak and roast item substitute for the holidays. Yet their growing popularity is holding strip loin prices on a higher plane this season. A few other items with impressive price points include shoulder clods and briskets, the latter of which are supported on smaller head counts and processer demand ahead of corned beef season.

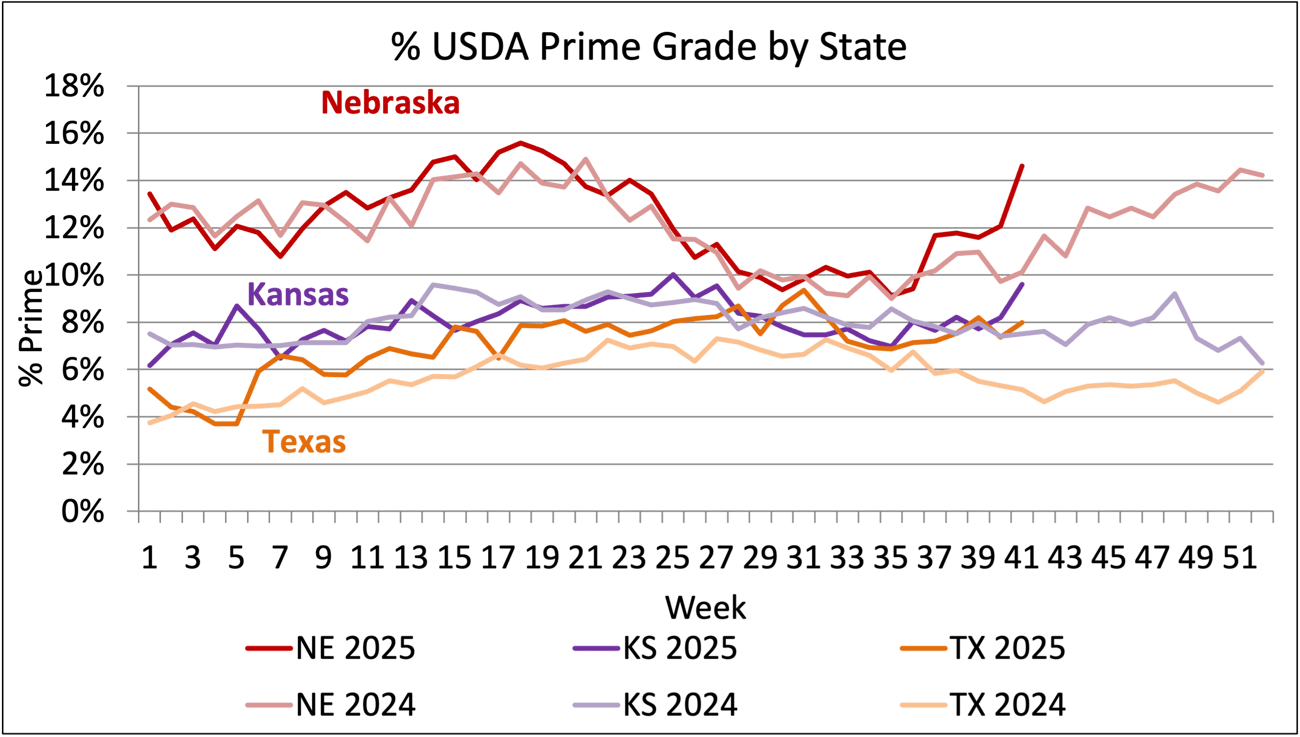

A final optimistic note for cattlemen is the widening of the USDA Prime cutout price spread above USDA Choice; the latest spread is $57/cwt. This bolstered average Prime grid premiums to $22.42/cwt. earlier this month and comes at a time when Prime carcass production is seeing an uptick. Nebraska takes the prize among the largest packing states as feeders in the region are delivering 14.6% Prime carcasses to packers, a big move from the 10% level seen the same week last year. Kansas and Texas grade trends are similarly impressive, with Kansas up to 9.7% and Texas closing the gap at 8% Prime. |

|

|

|

|

|

|

CAB Closes Its 2025 Fiscal Year

Today’s market is complex and competitive. The collective effort of stakeholders across the supply chain positions Certified Angus Beef to meet the record demand for premium beef moving forward. Signals across the beef industry are clear and Angus farmers and ranchers seeking high-quality genetics that deliver premium beef are producing a product in high demand.

READ THE REPORT |

|

|

Maplecrest Farms Receives CAB Ambassador Award

Maplecrest Farms bridges every step of the beef supply chain, from raising Angus seedstock to managing a retail meat store and hosting food industry partners. Their ability to connect ranching, genetics and consumer engagement earned them the 2025 CAB Ambassador Award.

READ MORE |

|

|

Did someone forward this email to you?

|

|

Manage Your Email Preferences

You are receiving this email because you opted in on our website, an industry event or have attended one of our events.

Certified Angus Beef, 206 Riffel Rd, Wooster, OH 44691, United States |

|

|